Agenda and minutes

Venue: Main Hall (1st Floor) - 3 Shortlands, Hammersmith, W6 8DA. View directions

Contact: Katia Neale Email: katia.neale@lbhf.gov.uk

Link: Watch the meeting live on YouTube

| No. | Item |

|---|---|

|

Minutes of the Cabinet Meeting held on 10 January 2022 Minutes: That the minutes of the meeting of the Cabinet held on 10 January 2022 be confirmed and signed as an accurate record of the proceedings, and that the outstanding actions be noted.

|

|

|

Apologies for Absence Minutes: Apologies for absence were received from Councillor Larry Culhane and Councillor Ben Coleman. |

|

|

Declaration of Interests If a Councillor has a disclosable pecuniary interest in a particular item, whether or not it is entered in the Authority’s register of interests, or any other significant interest which they consider should be declared in the public interest, they should declare the existence and, unless it is a sensitive interest as defined in the Member Code of Conduct, the nature of the interest at the commencement of the consideration of that item or as soon as it becomes apparent.

At meetings where members of the public are allowed to be in attendance and speak, any Councillor with a disclosable pecuniary interest or other significant interest may also make representations, give evidence or answer questions about the matter. The Councillor must then withdraw immediately from the meeting before the matter is discussed and any vote taken.

Where Members of the public are not allowed to be in attendance and speak, then the Councillor with a disclosable pecuniary interest should withdraw from the meeting whilst the matter is under consideration. Councillors who have declared other significant interests should also withdraw from the meeting if they consider their continued participation in the matter would not be reasonable in the circumstances and may give rise to a perception of a conflict of interest.

Councillors are not obliged to withdraw from the meeting where a dispensation to that effect has been obtained from the Standards Committee. Minutes: There were no declarations of interest. |

|

|

Revenue Budget And Council Tax Levels 2022/23 Additional documents:

Minutes: Councillor Max Schmid stated that this report would be debated and formally approved in over two weeks’ time at the Budget Council. He highlighted that while living costs and inflation were going up this Council was freezing Council Tax and had chosen not to apply the Government modelled 1% ‘adult social care precept’, resulting in a reduced burden on local taxpayers. These and the other measures proposed would not impair the delivery of services owing to £7.434m of new investment on new and better services for residents.

Councillor Schmid added that the budget proposals included prudent measures to strengthen the Council’s future financial resilience by contributing one-off resources of £2.1m to reserves and general balances.

The Leader commended Cllr Schmid, the Chief Executive, Kim Smith, and the Senior Management Team for the excellent report proposing greater investment fund into frontline services. He added that this was one of the very few councils in Britain to have frozen Council Tax without any extra funding from the Government. This was funded by the Council’s ruthlessly financially efficient programme, which eliminated bureaucracy and wastage, resulting in a modern effective business.

AGREED UNANIMOUSLY BY THE CABINET MEMBERS PRESENT:

That Cabinet recommend that Budget Council, for the reasons set out in this report and appendices, agree: 1. To freeze the Hammersmith & Fulham element of the council tax charge for 2022/23 and not apply the 2% increase modelled by the government for the coming year. 2. To not apply the government modelled “adult social care precept” levy of 1% for 2022/23, and to instead use council savings and income to fund growth in adult social care spending. 3. To set the Council’s own total net expenditure budget for 2022/23 at £125.657m. 4. To approve £7.434m of new investment on key services for residents. 5. To approve fees and charges, as set out in paragraph 10, including freezing charges in adult social care, children’s services and general fund housing. 6. To note the budget projections to 2025/26 made by the Director of Finance in consultation with the Strategic Leadership Team. 7. To note the statement of the Director of Finance, under Section 25 of the Local Government Act 2003, regarding the adequacy of reserves and robustness of estimates (paragraph 37). 8. To approve the reserves strategy and realignment of reserves as set out in Appendix J and Appendix K. 9. To require all Directors to report on their projected financial position compared to their revenue estimates in accordance with the Corporate Revenue Monitoring Report timetable. 10. To authorise Directors to implement their service spending plans for 2022/23 in accordance with the recommendations within this report, the Council's Standing Orders, Financial Regulations, relevant Schemes of Delegation and undertake any further consultation required regarding the Equalities Impact Assessment. 11. Set the Council’s element of council tax for 2022/23 for each category of dwelling, as outlined in the table below and in full in Appendix A and calculated in accordance with Sections 31A to 49B of the Localism Act ... view the full minutes text for item 4. |

|

|

Four Year Capital Programme 2022-26 And Capital Strategy 2022/23 Minutes: Councillor Max Schmid stated that this report had a compilation of the financial capital implications of the decisions made by the Council over recent years. In particular, the decisions prioritised the need for more genuinely affordable social housing to be delivered to the Civic Campus scheme alongside other benefits, and the provision of development financing to the EdCity scheme, which would bring a brand-new school and affordable housing. He stated that this report would be debated and formally approved in over two weeks’ time at the Budget Council.

The Leader stressed the importance of the youth facilities being built at the EdCity scheme in White City which would create engagement opportunities for young people. This was part of the Council’s industrial strategy.

AGREED UNANIMOUSLY BY THE CABINET MEMBERS PRESENT:

1. To approve the four-year General Fund Capital Programme budget at £187.6m for the period 2022/23-2025/26 (presented in Table 2 and Appendix 1).

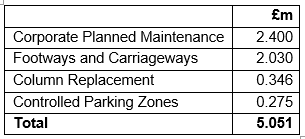

2. To approve the continuation of rolling programmes for 2022/23 funded from the Council’s mainstream resources. For financial modelling purposes, these programmes are assumed to continue at the same level until 2025/26:

3. To delegate approval of the detailed programmes for use of the rolling programmes, in recommendation 2, to the relevant SLT Director in consultation with the Director of Finance and relevant Lead Cabinet Member.

4. To approve the four-year Housing (HRA) Capital Programme at £389.6m for the period 2022/23-2025/26 as set out in Table 5 and Appendix 1.

5. To delegate authority to the Director of Finance in consultation with the Cabinet Member for Finance and Commercial Services to approve the potential use of up to £4.3m of capital receipts under the Government’s Flexible Use of Capital Receipts provisions for funding of Invest to Save schemes in 2022/23 and 2023/24 (as identified in Appendix 5) and potential match-funding opportunities.

6. To approve the Capital Strategy 2022/23, as set out in Appendix 4.

7. To approve the annual Minimum Revenue Provision policy statement for 2022/23, as set out in Appendix 6.

8. To note the existing mainstream funded schemes previously approved, but now reprofiled to 2022/23 and future years as detailed in Table 3.

|

|

|

Capital Programme Monitor & Budget Variations, 2021/22 (Third Quarter) Minutes: Councillor Max Schmid stated that this report reflected the capital activity over the year. The construction and capital projects had been affected by the negative impact of Brexit and the pandemic, consequently reducing the activity in some schemes. However, the EdCity and the Civic Campus schemes were still on track and progressing.

AGREED UNANIMOUSLY BY THE CABINET MEMBERS PRESENT:

1. To note the net forecast decrease in 2021/22 capital expenditure of £12m (9.4% of the approved budget). The variations are detailed in Appendix 2.

2. To approve the updated four-year capital programme 2021-2025 of £473.2m as detailed in Appendix 1.

3. To note the potential risks regarding the Housing Capital Programme, as summarised in paragraphs 20-22.

|

|

|

Treasury Management Strategy Statement 2022/23 Minutes: Councillor Max Schmid stated that this report would be debated and formally approved in over two weeks’ time at the Budget Council.

AGREED UNANIMOUSLY BY THE CABINET MEMBERS PRESENT:

1. That approval be given to the future borrowing and investment strategies as outlined in this report. 2. That the Director of Finance, in consultation with the Cabinet Member for Finance and Commercial Services, be delegated authority to manage the Council’s cash flow, borrowing and investments in 2022/23 in line with this report. 3. In relation to the Council’s overall borrowing for the financial year, to approve the Prudential Indicators as set out in this report and the revised Annual Investment Strategy set out in Appendix E.

|

|

|

Treasury Management Strategy: Mid-Year Review 2021/22 Minutes: AGREED UNANIMOUSLY BY THE CABINET MEMBERS PRESENT:

Cabinet is asked to note the Treasury Management Strategy 2021/22 mid-year review. |

|

|

Minutes: Councillor Lisa Homan stated that the proposed increase of 1.5% to rent and other charges was well below inflation and the Government’s suggested rent policy, and much lower than the rates proposed by other councils. She added that tenants and residents had been consulted on the plans at the Housing Representatives Forum and at the Economy, Housing and the Arts Policy & Accountability Committee, and they had fully endorsed this report.

Councillor Schmid and the Leader both added that the Council recognised the higher cost of living pressures faced by tenants due to rising inflation and new Government taxes. Therefore, the Council was proposing a real-terms rent reduction to help residents. Rent and other charges would only increase by 1.5%, which was well below the Government’s suggested rent policy of CPI inflation plus 1%, which would have resulted in a 4.1% rent increase.

AGREED UNANIMOUSLY BY THE CABINET MEMBERS PRESENT:

1. To approve the Housing Revenue Account 2022/23 budget for Council homes as set out in Table 1.

2. To approve the 40-year financial plan for Council homes for 2021-2061, which requires an increase in the ongoing annual revenue savings (when compared to the 2021/22 base budget) of £3.8 million per annum from 2022/23, rising to £7.1m from 2023/24 and to £7.9m from 2024/25.

4. To approve an increase to shared ownership rents of 1.5% from 4 April 2022.

5. To approve an increase to tenant service charges of 1.5% from 4 April 2022, which equates to an average weekly increase for tenants of £0.13 in 2022/23.

6. To approve an increase to the management fee for temporary on licence properties of 1.5% from 4 April 2022.

7. To increase garage charges for council tenants, resident leaseholders, and for other customers from April 2022 by 1.5%.

8. To note that any change to parking charges on housing estates will be considered separately with the Council’s parking plans.

9. To increase car space rental charges for all customers by 1.5% from April 2022.

10.To approve an increase in the Leasehold After Sale – Home Buy Fees by 1.5% from April 2022 from £200 to £203.

11.To note that an external review of the service will be undertaken in early 2022 to identify further savings in the Housing Service.

|

|

|

Short Breaks Statement and Pathways to Assessment Guidance Additional documents:

Minutes: The Leader stressed that this was one of the cutting-edge schemes done by the Council to support the needs of young people, along with the recreational time that they needed in very challenging circumstances.

AGREED UNANIMOUSLY BY THE CABINET MEMBERS PRESENT:

To approve the updated Short Breaks Statement and Pathways to Assessment document, attached at Appendix 1 and 2.

|

|

|

Forward Plan of Key Decisions Minutes: The Key Decision List was noted. |

|

|

Discussion of Exempt Elements (If Required) LOCAL GOVERNMENT ACT 1972 - ACCESS TO INFORMATION

Proposed resolution:

Under Section 100A (4) of the Local Government Act 1972, that the public and press be excluded from the meeting during the consideration of the following items of business, on the grounds that they contain the likely disclosure of exempt information, as defined in paragraph 3 of Schedule 12A of the said Act, and that the public interest in maintaining the exemption currently outweighs the public interest in disclosing the information.

Minutes: There was no discussion of exempt elements |

PDF 263 KB

PDF 263 KB